Why Thynk

لماذا تختار ثينك

THYNK is a fully integrated AI based real time rules edit engine that supports medical billing processes for immediate tangible financial value. It detects policy violation in real time at each touch point of the patient’s journey.

Patient Eligibility &

Pre Approval Checks

KSA Regulatory Standards for

NPHIES, ICD10 AM, ACHI,

Saudi Billing System (SBS)

Supports ICD10 CM, CPT

(v. 2018 & 2022) standards

in the UAE

HIS integration covering al RCM

touch point across the patient journey

Medical Necessity &

Documentation Checks

HIS integration covering al RCM

touch point across the patient journey

-

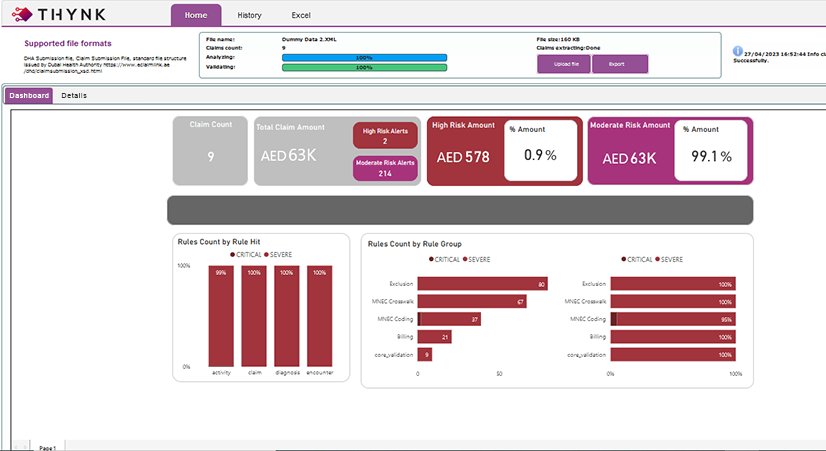

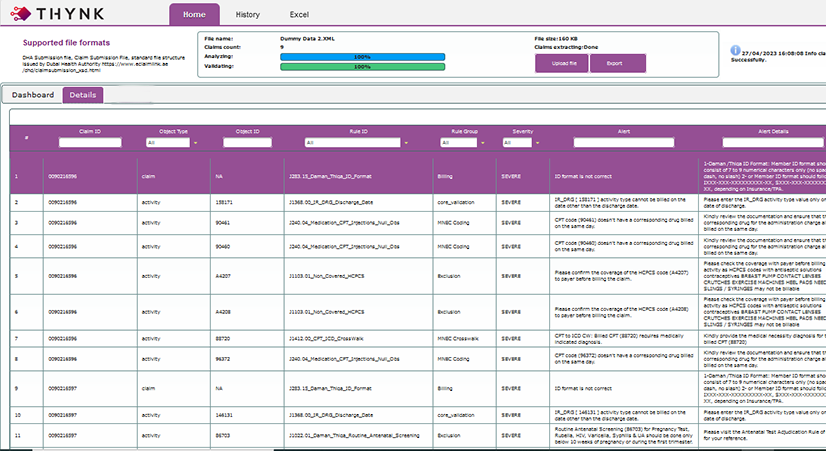

User friendly, Easy to Set up

-

Highlights Revenue Leakage Granulary

-

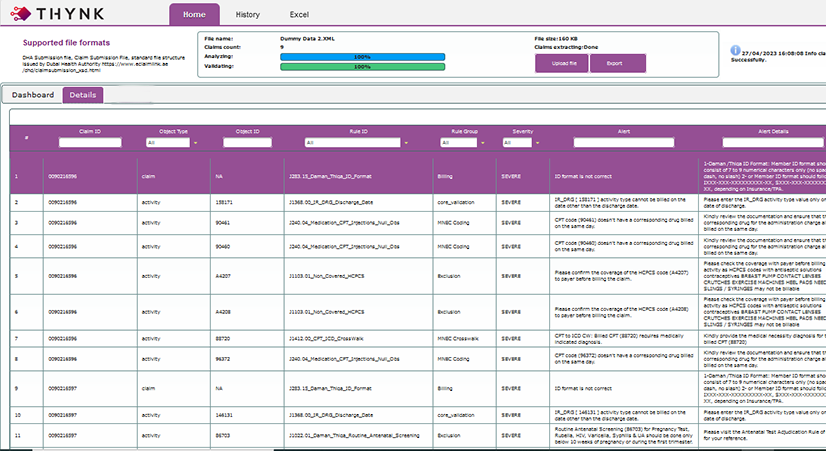

Provides Breakdown of Denials’ Activity Category Wise

-

Breaks Down Rejections Severity Wise

-

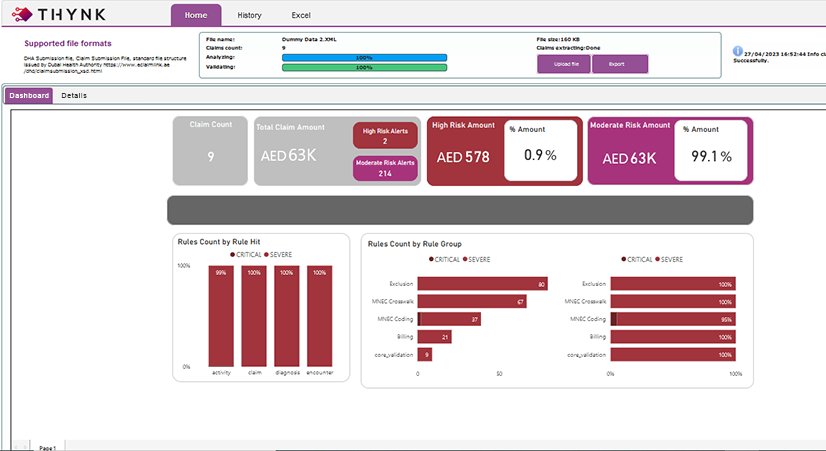

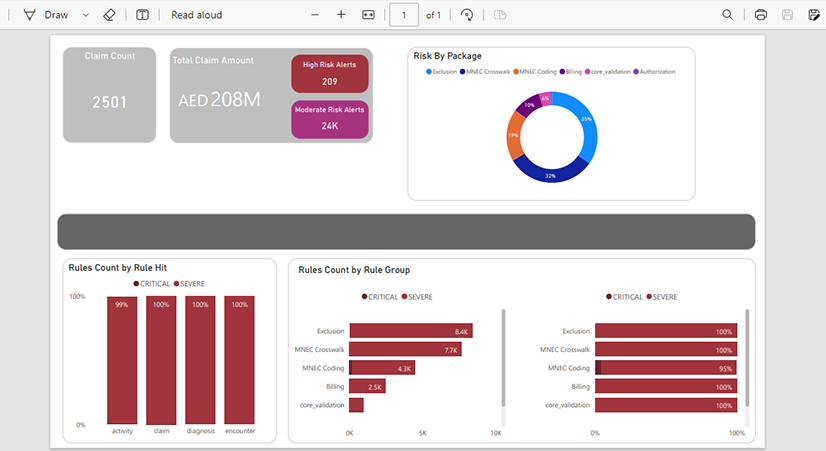

Provides a Quick Glance on Overall Claim Health

-

Highlights the Issues & Advises Resolutions

-

Download-able Results in Both PDF & Excel Formats

-

User friendly, Easy to Set up

-

Highlights Revenue Leakage Granulary

-

Provides Breakdown of Denials’ Activity Category Wise

-

Breaks Down Rejections Severity Wise

-

Provides a Quick Glance on Overall Claim Health

-

Highlights the Issues & Advises Resolutions

-

Download-able Results in Both PDF & Excel Formats

FEATURES & BENEFITS

الميزات والفوائد

Our Rule Content Includes & Supports

PLANS & PACKAGES

الخطط والحزم

All our solutions are based on flexible pricing

plans to suit a wide variety of business needs

LISENCING OPTIONS

Read More>

THYNK has over 4 Million business rules logic (rule edits) to detect and report errors and gaps that may exist in the medical claim

based on the regulatory and payer rules, policies and circulars from major regional regulatory bodies such as:

– Corporate Council for Health Insurance (CHI)- KSA

– Department of Health (DoH)- Abu Dhabi

– Dubai Health Authority (DHA)- Dubai

– Riayati– Northern Emirates

The rules reviews are based on:

– Claim mandatory data elements. Forming the minimal required data set to perform a claim scrubbing rules edits validation.

– Claim optional data elements. To enhance the accuracy and comprehensiveness of rule edits validations.

– Members Insurance Details, such as patient policy particulars.

– Payer Contract and Pricing based rules.

– Patient Demographics, such as age, gender …etc.

– Patient claims/encounters history.

• Core Crosswalks:

– International Crosswalks (CPT-ICD10CM and ACHI/ICD10AM)

– Local Crosswalks Localized UAE and KSA market crosswalks – based on payers/regulator guidelines.

• Extended Crosswalks:

Offering a wider scope extending on core MNEC Crosswalks and will include the following:

– National Correct Coding Initiative Edits (NCCI)

– Medically Unlikely Edits (MUEs)

– Principle Diagnosis Selection (PDx)

– Etiology/Manifestation coding

– Drugs-ICD Crosswalks: Local market Rule Edits

– Gender-ICD Crosswalks. International reference

– Gender-CPT crosswalks: International reference

– Age-CPT crosswalks: International reference

– Maternity-CPT crosswalks: International reference

– Laboratory Panel Coding

– Infusion/injection Coding

Read More>

Support for developing business custom rules content managed by a team of expert rule and market expert teams to support

your RCM automation and specific review and validation needs.

Read More>

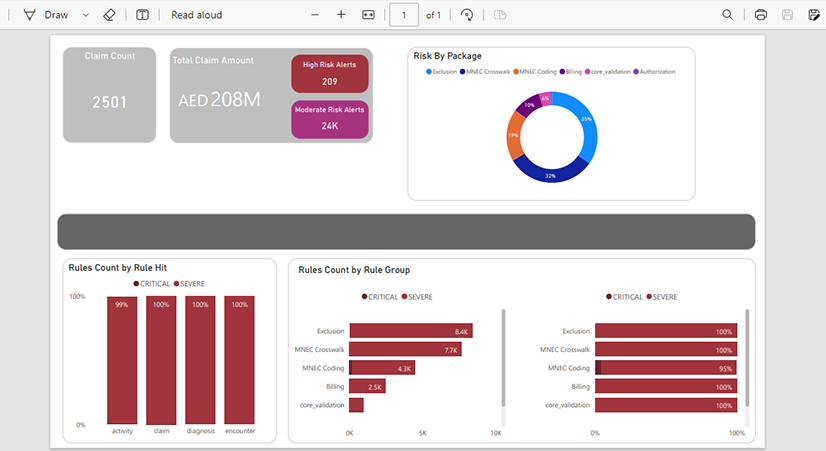

Provides a comprehensive and visualized dashboards as well as tabular representation to help discovering areas for improvements and make your team prepared to act proactively on RCM related issues.

Machine Learning Models

Read More>

Advanced Machine Learning (ML) models covering:

a. Historical claims denial and payment patterns and prediction of future denial risk.

b. Denials not covered by rules and propose suggested rules to cover denials risk.

Read More>

THYNK provide an API and an integration engine that supports HL7 and Webservices capability to streamline the integration with current HIS solution.

SaaS

ENTERPRISE

-

Rule Edits Content Read More

-

Age & Gender

-

Contract Management Checks

-

Medical Coding & Medical Necessity

-

Payer & Billing

THYNK has over 4 Million business rules logic (rule edits) to detect and report errors and gaps that may exist in the medical claim

based on the regulatory and payer rules, policies and circulars from major regional regulatory bodies such as:

– Corporate Council for Health Insurance (CHI)- KSA

– Department of Health (DoH)- Abu Dhabi

– Dubai Health Authority (DHA)- Dubai

– Riayati– Northern Emirates

The rules reviews are based on:

– Claim mandatory data elements. Forming the minimal required data set to perform a claim scrubbing rules edits validation.

– Claim optional data elements. To enhance the accuracy and comprehensiveness of rule edits validations.

– Members Insurance Details, such as patient policy particulars.

– Payer Contract and Pricing based rules.

– Patient Demographics, such as age, gender …etc.

– Patient claims/encounters history.

• Core Crosswalks:

– International Crosswalks (CPT-ICD10CM and ACHI/ICD10AM)

– Local Crosswalks Localized UAE and KSA market crosswalks – based on payers/regulator guidelines.

• Extended Crosswalks:

Offering a wider scope extending on core MNEC Crosswalks and will include the following:

– National Correct Coding Initiative Edits (NCCI)

– Medically Unlikely Edits (MUEs)

– Principle Diagnosis Selection (PDx)

– Etiology/Manifestation coding

– Drugs-ICD Crosswalks: Local market Rule Edits

– Gender-ICD Crosswalks. International reference

– Gender-CPT crosswalks: International reference

– Age-CPT crosswalks: International reference

– Maternity-CPT crosswalks: International reference

– Laboratory Panel Coding

– Infusion/injection Coding

-

Rule Edits Content Read More

-

Age & Gender

-

Contract Management Checks

-

Medical Coding & Medical Necessity

-

Payer & Billing

-

Pre-Authorization Rules

-

Price and Patient Share Checks

-

Provider Custom Rules Read More

-

Analytics & Dashboards Read More

-

Predictive Analytics & AI

Machine Learning Models Read More -

HIS Integration Engine Read More

THYNK has over 4 Million business rules logic (rule edits) to detect and report errors and gaps that may exist in the medical claim

based on the regulatory and payer rules, policies and circulars from major regional regulatory bodies such as:

– Corporate Council for Health Insurance (CHI)- KSA

– Department of Health (DoH)- Abu Dhabi

– Dubai Health Authority (DHA)- Dubai

– Riayati– Northern Emirates

The rules reviews are based on:

– Claim mandatory data elements. Forming the minimal required data set to perform a claim scrubbing rules edits validation.

– Claim optional data elements. To enhance the accuracy and comprehensiveness of rule edits validations.

– Members Insurance Details, such as patient policy particulars.

– Payer Contract and Pricing based rules.

– Patient Demographics, such as age, gender …etc.

– Patient claims/encounters history.

• Core Crosswalks:

– International Crosswalks (CPT-ICD10CM and ACHI/ICD10AM)

– Local Crosswalks Localized UAE and KSA market crosswalks – based on payers/regulator guidelines.

• Extended Crosswalks:

Offering a wider scope extending on core MNEC Crosswalks and will include the following:

– National Correct Coding Initiative Edits (NCCI)

– Medically Unlikely Edits (MUEs)

– Principle Diagnosis Selection (PDx)

– Etiology/Manifestation coding

– Drugs-ICD Crosswalks: Local market Rule Edits

– Gender-ICD Crosswalks. International reference

– Gender-CPT crosswalks: International reference

– Age-CPT crosswalks: International reference

– Maternity-CPT crosswalks: International reference

– Laboratory Panel Coding

– Infusion/injection Coding

Support for developing business custom rules content managed by a team of expert rule and market expert teams to support

your RCM automation and specific review and validation needs.

Provides a comprehensive and visualized dashboards as well as tabular representation to help discovering areas for improvements and make your team prepared to act proactively on RCM related issues.

Advanced Machine Learning (ML) models covering:

a. Historical claims denial and payment patterns and prediction of future denial risk.

b. Denials not covered by rules and propose suggested rules to cover denials risk.

THYNK provide an API and an integration engine that supports HL7 and Webservices capability to streamline the integration with current HIS solution.